Weekly review and free levels/setups for 7/28

With bulls driving futures to all-time highs (ATHs) for five consecutive weeks, FOMC and big tech earnings this week.

Hello traders, This is free newsletter sent out every week. To join my telegram subscribe thru my substack. Big prop firm promotions. Apex has 90% off evals Use FT400 code. $50resets and Fundingticks (New firm) 35% OFF all Accounts Evals (Pro+) starting at $64 Straight to funded (Zero) starting at $216 Use Code: F400 (its not FT400 as their naming does not allow me that code). Now back to business.

Last week we again saw ATHs on NQ and ES futures. This week market has already opened very bullish with tariff deal with EU setting a baseline tariff rate of 15% on EU goods imported to the U.S., down from a threatened 30%. Reports also indicate that the U.S. and China are expected to extend their 90-day tariff pause, set to expire on August 12, for another three months. Current tariffs on Chinese goods remain at 30% (10% baseline + 20% fentanyl-related). This extension, following talks in Stockholm, could reduce near-term trade tensions, supporting market optimism, especially for tech and retail sectors reliant on Chinese imports. Overall week is already setting up very bulish with reduced market uncertainity.

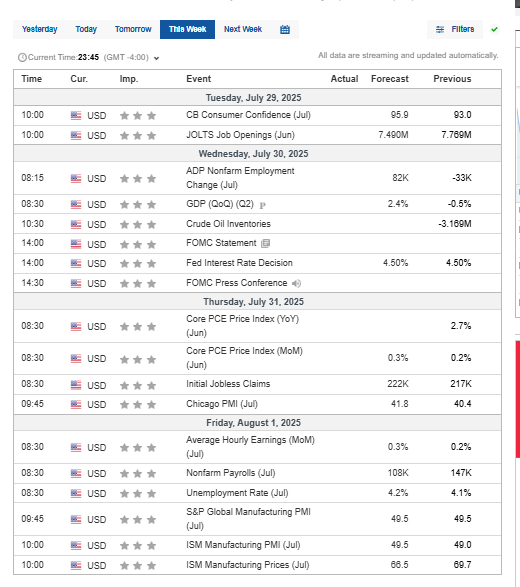

Key economic events:

Tuesday, July 29: U.S. Consumer Confidence and JOLTS data may signal consumer spending and labor market trends, affecting consumer discretionary and growth stocks.

Wednesday, July 30: FOMC interest rate decision (likely unchanged at 4.25%–4.50%) and Q2 GDP (est. 2.0%) could drive market sentiment. Dovish Fed signals may lift tech; hawkish tones could pressure equities.

Thursday, July 31: PCE inflation (est. 2.5%) and jobless claims will influence rate cut expectations, impacting valuations, especially in tech and real estate.

Friday, August 1: Nonfarm Payrolls (est. 117.5K) and U.S. tariff deadline developments could sway cyclical sectors and trade-exposed stocks like retail and industrials.

Key Corporate Earnings

Tuesday, July 29: Merck (MRK), Procter & Gamble (PG), Boeing (BA), Visa (V), Starbucks (SBUX).

Wednesday, July 30: Meta Platforms (META), Microsoft (MSFT), Qualcomm (QCOM).

Thursday, July 31: Apple (AAPL), Amazon (AMZN), AbbVie (ABBV), Comcast (CMCSA).

Friday, August 1: Exxon Mobil (XOM), Chevron (CVX).

Earnings from major technology firms (Apple, Amazon, Meta, Microsoft) could significantly sway the Nasdaq and S&P 500, given their market weight. Strong results may drive gains in tech-heavy indices, while disappointments could trigger sell-offs. Energy stocks like Exxon and Chevron may react to oil price trends and tariff-related cost pressures.

Trade reveiws from X posts from last week as usual we played both sides.

On July 21, we liquidated our short positions at the 46 level for a 20-handle gain and shorted the 68/72 area, securing 10+ handles on our second attempt. We noted that bears lacked momentum unless they broke 46 decisively, with 56 being a critical level. Below 56/60, bears could push lower. We also shared key levels in our free Substack newsletter, highlighting 32/36 as pivotal, and held a short from 68 in Globex, targeting 12/16 if bears broke 32/36.

On July 22, we shorted the RTH open versus 46, aiming for 20, with 16 as a key level and further targets at 6302 and 6280. We pointed out that bulls needed to reclaim 32/36 for upside. Later, we noted 16/20 held the downside, and recovering 32/36 sparked a 10+ handle rally. We suggested trimming positions, leaving a runner for 6356, and flipping long if 32 failed. We also mentioned upcoming Tesla and Google earnings.

On July 23, we traded long at 56 and short at 66 multiple times, staying sidelined to avoid a volatility spike from an EU tariff deal. We went long at 72/76, then later at 76, targeting 6396/6400, with 6430 possible if momentum held.

On July 24, we took multiple long trades from the 96 area in Globex and RTH, securing 10+ handles, and shorted from 12 to 00. When bears failed to break 96, we predicted new all-time highs, hitting our 6416 target. We stayed out during the choppy power hour and noted 16 and 04 as key levels moving forward. Later, we called Globex choppy, emphasizing 6416 as critical—bears needed to break 6400 for a retracement to 6360, while above 6416, we targeted 6432 for the next RTH session.

Prop Firms Promotions

I will list best promotions on good prop firms going forward. They are best way to learn and make money without blowing up 100’s of thousands of your own dollars.

Apex has 90% off evals Use FT400 code. $50resets.

Fundingticks (New firm) 35% OFF All Accounts Evals (Pro+) starting at $64 Straight to funded (Zero) starting at $216 Use Code: F400 (its not FT400 as their naming does not allow me that code)

TakeProfitTrader 40% Off & no activation fees. Use FT400 code.

TicktickTrader has 70% off Straight to funded accounts, 30% evals. Use FT400 code

Econ Calendar:

Night session Trading Suggestions:

I suggest to not trade night session from 10 pm to 2 am chop. If action has to happen than it will happen before 10 pm or after 2 am EST. You can generally play short on top level provided for nightly range and long on lower level of nightly range after 2 am or 3 am. But get out of the way if it rips or drops thru levels and wait for new opportunity or flip. And of course never add to loser and better yet cut it and reset.

Remember: I never short above or long below my marker. I wait for it to pause before it or come back to it from rip/dip and pause before executing.

Never take position before Econ like CPI Or FOMC. After econ watch for levels where it stops and how it interacts to decide long or short.

Recommended stop: -2 and go to BE on +2. Some ppl who can't reenter shall chose -3.5/4.

Scale out: 2 lots at +6/8, 3rd at +10/16, 4th leave runner at BE

Big picture: > 5700 this remains bullish.

Rest of the content is for paid sub stack users and is also shared with members on private telegram channel (Note to telegram members: please do not ask me that you do not have sub stack access, you don’t but the content behind paywall is already posted on your channel. Thank you).

Sub stack subscription does not include real time telegram alerts it only includes this nightly news letter with levels and possible setups. For real time alerts please go to https://futuretrader400.substack.com/about

Levels, & Possible Targets: 🔥🔥= Critical (These are now for September U Contract)

Long term view: As far as > 5700 tape remains in bulls’ control

Bull bear: 6456 (Weekly bull bear level is 6396 )

Above: 6456, 6476 , 6494, 6508🔥

Below: 6432🔥, 6416, 6396🔥🔥, 6376, 6360🔥, 6336, 6316

Trade ideas: Overall long bias. Long > 6432 if reaches there. Short vs 6452 as far as 6456 does not print. Better short is vs 6432 on break of 6428.

Note: Use my globex Pivot/opening setup as main directional guide and then other setups as guidance. Flip or go flat if setup reverses as I may not be in front of my screen all day, you should by now know how the process works at most you have 2/4 handle risk. Setup generally reverses on 1 minute close above/below 3/4 handles from marker. Again there is no sure shot as some time I might relax that or may go predictive. That’s general rule anyway. Also most of the time setups always gives opportunities to reenter some time even multiple times so never take trade too far away from setup markers