Week of Sept 15th - ES/SPX futures Levels and Setups

New ATH on ES and NQ futures, FOMC rate cut looming this week after high CPI print

This is free newsletter sent out every week with setups/levels on ES/SPX futures. For daily setups/levels join by subscribing thru my substack.

Flash Sale discount: Planning to give out flash sale discounts to those who leaves comment “Interested” to this post, once I get at least 200 people to respond. Until I garner 200 responses all those who responds will be placed in the queue to get the flash sale code.

Prop firm promotions (Lame discount so wait out)

Apex has 80% off evals Use FT400 code.

Fundingticks (New firm) 20% OFF all Accounts Use Code: F400 (its not FT400 )

TakeProfitTrader 40% Off & no activation fees. Use FT400 code.

Review of last week trades

Here’s a summary of ES futures trading from last week.

September 8, 2025:

We reported shorting the 06 level since the open, which delivered multiple 18-handle gains on three occasions, while highlighting 94 as a key level. We noted that our provided edges at 6494, 6520, and 6506 were sufficient for extracting handles throughout the day, describing the session as choppy until those levels were breached.

September 9, 2025:

We reiterated that the previous day's levels (6494, 6520, 6506) continued to perform effectively, maintaining a choppy market environment until a decisive break above or below those edges occurred.

September 10, 2025:

We detailed taking a long position at the close versus 6516, which broke out of the 6594-6620 range, and a Globex long versus 6524, both yielding strong gains with liquidation around 6560+. Since the open, we shorted the 56 level amid choppy conditions, advising small handles with runners and potential flips. Key levels above included 6566, 6580, and 6600; below were 6540 and 6524. Later, we secured additional handles shorting versus 56 and then 44, noting bears targeting 16/20 if 40/44 held, while bulls could reclaim all-time highs if they converted 40/44 in the power hour. We commented on lower volatility likelihood due to CPI the next day.

September 11, 2025:

We reported longing 54 after hesitation at 44 (a provided pivot), liquidating near the 86s in the morning. Bulls controlled the last two hours if holding above 76, targeting 6600/16, but a giveaway of 76 could retrace to 54s. We confirmed the 6600 tag as expected, with Globex remaining long above 84 and key levels at 80, 6600, 6616 (and higher); below were 6566 and 6554. For Globex, the bull/bear line was at 6544, with upside at 62/66 and downside at 24 and 06.

September 12, 2025:

In the morning, we outlined the best setups as longs versus 6554 or 6516/06 on drops, with shorts viable as long as 94 held upside at the open—but if unable to take out 76, we expected a slow grind higher, requiring bulls to stay above 94 for a trend day once exceeding 6616. At day's end, we noted bears grabbed a few handles shorting 94 but failed to breach 76, leading to a grind up to 6600+ before closing below 94. This favored bulls for the Sunday open if holding 76/80, needing to reclaim 94 decisively, and we advised trading small ahead of FOMC next week.

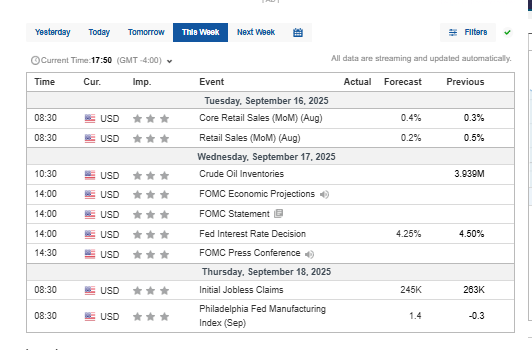

Key Economic events Next week

Key economic events that could influence indices:

The week’s focus is the FOMC’s expected 25bp rate cut (from 4.25%-4.50%) on Wednesday Sep 17, with the dot plot and Powell’s presser driving volatility to indices. Dovish signals could lift equities; hawkish tariff/inflation comments may trigger sell-offs, especially in tech. Key data this week includes:

Tue, Sep 16: Retail Sales (Aug, +0.2%) – Strong data may curb cut bets, pressuring stocks; weak print lifts indices.

Wed, Sep 17: Housing Starts (1.28M), Building Permits (1.40M) – Soft housing data supports easing, boosting real estate (XLRE).

Wed, Sep 17: Beige Book – Economic anecdotes; cooling labor/inflation aids rally.

Thu, Sep 18: Jobless Claims (235K), Philly Fed Index (-5.0), Leading Index (-0.5%) – Weak labor or manufacturing supports dovish bets, lifting stocks; strong data may weigh on cyclicals.

Volatility peaks mid-week; tariff risks and revised job data (-911K through Mar) add caution, though Q3 GDP nowcast (+3.1%) supports optimism.

Levels and Setups: 🔥🔥= Critical

(These are now for December Z Contract)

Long term view: As far as > 6300 tape remains in bulls’ control

Bull bear: 6636 (Weekly bull bear level is 6600 )

Above: 6636, 6650, 6666🔥🔥, 6682, 6700

Below: 6616, 6600🔥🔥, 6584, 6566, 6544🔥🔥, 6464🔥🔥, 6360🔥🔥

Setup 1: Long vs 6640. 6636 is risk marker and level, flip Short vs 40 on break of 33.

Setup 2: Short vs 6666 , risky though so small size. Flip if it rips thru it.

Setup 3: Long vs 6600 if it reaches there.

Setup 3: Long vs 6544 once it starts holding after flush down

Trading Times Suggestions

Globex: 2 am to 4 am EST or After 830 Econ

RTH: 930 am thru 11 am and 2 pm to 3:30 pm . First few minutes of open can be choppy.

Setup usage suggestion

Do not try setups more than once if you have to > 3.5 handle stop loss or twice if you are take <=2 handle stop loss. Use my globex Pivot/opening setup as main directional guide and then other setups as guidance. Flip or go flat if setup reverses as I may not be in front of my screen all day, you should by now know how the process works at most you have 2/4 handle risk. Setup generally reverses on 1 minute close above/below 3/4 handles from marker. Again there is no sure shot as some time I might relax that or may go predictive. That’s general rule anyway. Also most of the time setups always gives opportunities to reenter some time even multiple times so never take trade too far away from setup markers.

Size, Stop, Scale out strategy

Remember: I never short above or long below my marker. I wait for it to pause before it or come back to it from rip/dip and pause before executing.

Avoid taking position before Econ like CPI Or FOMC. After econ watch for levels where it stops and how it interacts to decide long or short.

Size: Either 4 micro or 4 emini lots or in multiple of 4’s, risking max 1-5% of your capital.

Recommended stop: Depends on your trading style. You can start with disaster stop of -4 and

Move to -2 once you are +2 on trade

Once you hit T1 you can go to -2 and when you hit T2 you can go to BE Or

Move to BE once you are +2

Move to BE if trade is taking more than 4-5 minutes after entry

Some folks like to keep it all the way to next level though I do not like to keep my trade that loose.

Scale out: 2 lots at +6/8, 3rd at +10/16, 4th start trailing if more than 20 handles on the trade.

Interested

Interested