Week of Nov 3 - ES/SPX futures Levels and Setups

New ATH last week with narrow range, bulls continue to hold near highs.

This is free newsletter sent out every week with setups/levels on ES/SPX futures. For daily setups/levels join by subscribing thru my substack.

Prop firm promotions

Apex has 70% off evals, $70 resetes and $40 PA fees. Use FT400 code.

Fundingticks (New firm) 20% OFF (35% off to new users) all Accounts including their Straight to funded Zero accounts Use Code: F400 (its not FT400 )

TakeProfitTrader 40% Off & no activation fees. Use FT400 code.

Review of last week trades

On October 27, we entered a long position at 6888 during Globex, capturing about 20 handles amid a bleeding upward trend. Key levels included a bull/bear pivot at 6888/6892, with resistance at 6908 and 6936 above, and support at 6860 and 6840 below.

On October 28, we liquidated the prior long around 6926 for profits, then shorted the open at 6926 and covered near 6912. We re-entered long at 6918, holding a runner targeting 6936 or higher, though FOMC volatility tempered expectations for major moves.

October 29 we highlighed a bull/bear line at 6918/6922 We outlined long setups above 6918/6922 for a potential “hockey stick rally,” shorts at 6908 converting to 6888 or lower, and longs above 6824 or 6790 on pullbacks. An X post refined this to a 6940 pivot, with 6888 as downside support and 6960+ as upside potential. Scaling strategies included partial exits at +6-8 and +10-16 handles, with stops tightening to breakeven after initial profits.

On October 31, we recapped the prior session’s action: Globex shorts above 6940/6936 delivered multiple handles, a 6888 conversion yielded around 20 handles long, and shorts from 6908 produced gains down to 6882 support (where we shorted 6882 to session lows before earnings noise intervened). For the day, we flagged short setups versus 6908, 6882, and 6860, with 6824 as critical support and a potential rotation back to 6882 on a 6860 conversion. Globex pivoted at 6908.

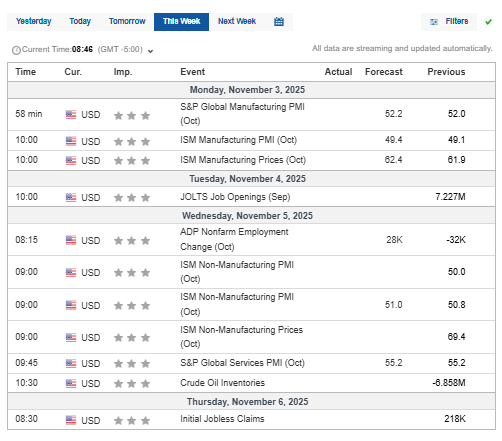

Key economic events/Earnings that could influence indices:

Levels and Setups Monday Nov 3rd: 🔥🔥= Critical

(These are now for December Z Contract)

Long term view: As far as > 6300 tape remains in bulls’ control.

Bull bear: 6888 (Weekly bull bear level is 6790)

Above: 6908, 6936,6960🔥, 6980, 7000 ,7036🔥🔥

Below: 6888🔥🔥, 6860, 6840, 6824🔥, 6812, 6790🔥🔥

Econ: 945 PMI and 10 ISM

Setup: Long vs 6888 as far as it holds downside

Setup: Short 6888 on conversion on coversion though 6860 needs to go for continuation

Setup: Long vs 6824 as far as it holds downside.Setup: Long vs 6790 or 6766 on further decline

Trading Times Suggestions

Globex: 2 am to 4 am EST or After 830 Econ

RTH: 930 am thru 11 am and 2 pm to 3:30 pm . First few minutes of open can be choppy.

Setup usage suggestion

Do not try setups more than once if you have to > 3.5 handle stop loss or twice if you are take <=2 handle stop loss. Use my globex Pivot/opening setup as main directional guide and then other setups as guidance. Flip or go flat if setup reverses as I may not be in front of my screen all day, you should by now know how the process works at most you have 2/4 handle risk. Setup generally reverses on 1 minute close above/below 3/4 handles from marker. Again there is no sure shot as some time I might relax that or may go predictive. That’s general rule anyway. Also most of the time setups always gives opportunities to reenter some time even multiple times so never take trade too far away from setup markers.

Size, Stop, Scale out strategy

Remember: I never short above or long below my marker. I wait for it to pause before it or come back to it from rip/dip and pause before executing.

Avoid taking position before Econ like CPI Or FOMC. After econ watch for levels where it stops and how it interacts to decide long or short.

Size: Either 4 micro or 4 emini lots or in multiple of 4’s, risking max 1-5% of your capital.

Recommended stop: Depends on your trading style. You can start with disaster stop of -4 and

Move to -2 once you are +2 on trade

Once you hit T1 you can go to -2 and when you hit T2 you can go to BE Or

Move to BE once you are +2

Move to BE if trade is taking more than 4-5 minutes after entry

Some folks like to keep it all the way to next level though I do not like to keep my trade that loose.

Scale out: 2 lots at +6/8, 3rd at +10/16, 4th start trailing if more than 20 handles on the trade.