Thoughts for Monday 2/5

Powell on tape tonight and then PMI and ISM tomorrow and more earnings

Hope you all had great weekend and those who did not do good last week has analyzed their trades.

For any one struggling generally main reason they are struggling is either they are not there when setup materializes or they are waiting for more validation and then chasing later on. Don’t keep trading same setups if you had one or two -2/-4 stop loss, at that point just better to wait for next setup or next day.

Sub prices going up for new members: I am opening subscription with old sub price of $200/month for telegram alerts until Feb 16 weekend and then will raise price for any new members after that. Existing members will continue to receive subscription with old sub price until they cancel their sub. Now back to the post.

Recap of Friday: Big day on Friday in FT land. We had 50 as bull bear and 50 acted as good support during Globex giving few points all night. But after NFP at 8:30 am we flipped short against 46 which gave 10+ points couple times.

We longed at 34 once it started holding. 34 was our level. This gave a good run to almost 4980 where I got out from longs. We did had long against 50 as second chance in between for those who missed the 34 long bus. We shorted 80 which gave 8+ points couple times. We had 92 as short to end the day but we could not get into it as it was a chase. Lets see what Globex today brings with war talk and Powell on tape at 7 pm.

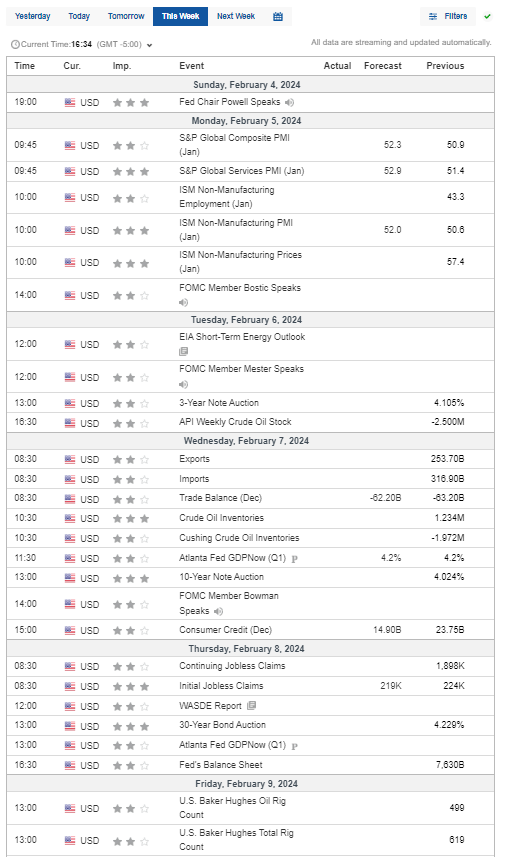

Econ for Week:

Night session Trading Suggestions:

I suggest to not trade night session from 10 pm to 2 am chop. If action has to happen than it will happen before 10 pm or after 2 am EST. You can generally play short on top level provided for nightly range and long on lower level of nightly range after 2 am or 3 am. But get out of the way if it rips or drops thru levels and wait for new opportunity or flip. And of course never add to loser and better yet cut it and reset.

Remember: I never short above or long below my marker. I wait for it to pause before it or come back to it from rip/dip and pause before executing.

Never take position before Econ like CPI Or FOMC. After econ watch for levels where it stops and how it interacts to decide long or short.

Recommended stop: -2 and go to BE on +2. Some ppl who can't reenter shall chose -3.5/4.

Scale out: 2 lots at +6/8, 3rd at +10/16, 4th leave runner at BE

Big picture: We had short stint inside 400 point chop box during last week of October but now we are back outside, until we go back inside bulls are on full control of the tape.

Rest of the content is for paid sub stack users and is also shared with members on private telegram channel (Note to telegram members: please do not ask me that you do not have sub stack access, you don’t but the content behind paywall is already posted on your channel. Thank you).

Sub stack subscription does not include real time telegram alerts it only includes this nightly news letter with levels and possible setups. For real time alerts please go to https://futuretrader400.substack.com/about