Plan for Oct 8 Tuesday

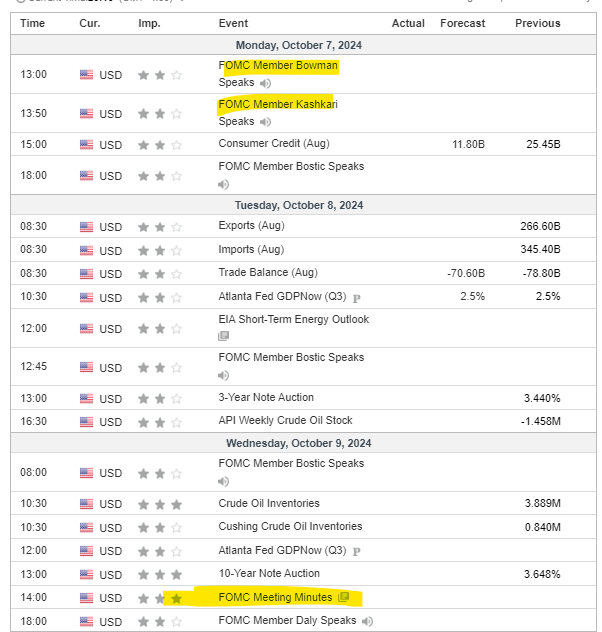

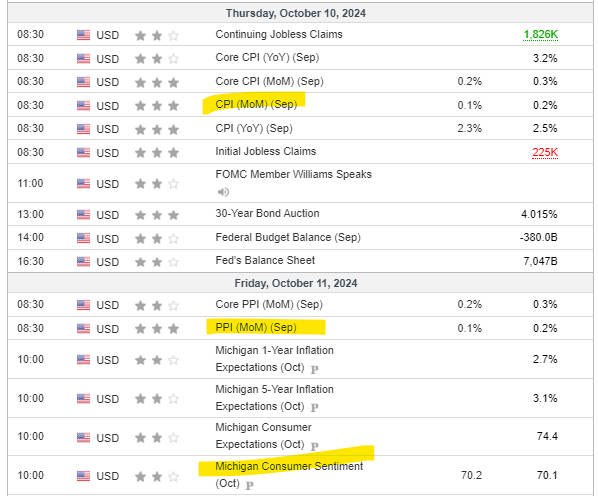

Middle East , CPI on Thursday and PPI on Friday in focus this week

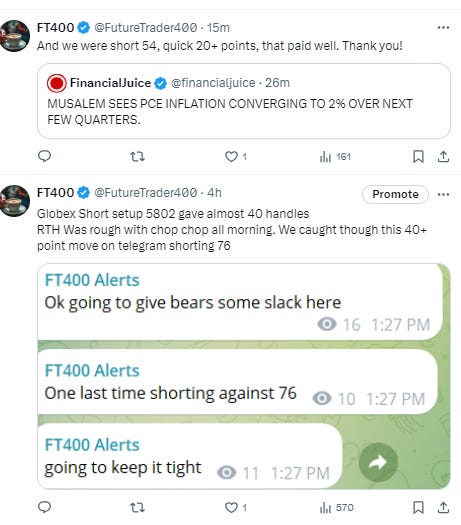

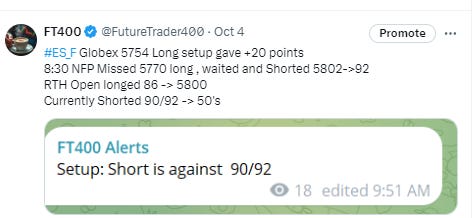

Folks, hope you enjoyed your weekend. I accidentally sent wrong summary of the day yesterday, so posting what we did on Friday here for reference. This was our day on Friday and Today as in series of X posts. We shored 5776 in RTH and then got out of that. Shorted again 5754 couple times and still short against that level.

Today:

Friday:

Prop Firms Promotions

I will list best promotions on good prop firms going forward. They are best way to learn and make money without blowing up 100’s of thousands of your own dollars. Fast track trading is promising prop firm that you should give a try with huge discount and direct funding without evaluation.

Apex has 80% off evals and $35 resets and 150k, 250K, 300K special price $50 Plus $85 LIFETIME PA fees all account sizes Use FT400 code. Use these evaluations very wisely. Promo ends in a day. Most likely 90% might be coming.

FastTrackTrading has Code: ftt_45 - 45% off Rally, Daytona and GT and additional 10% off with code apology_tour, and Le Mans: ftt_lemans - 15% off Le Mans. There is no evaluation, no activation and no monthly fees. They are now offering credit card option with lower discount though at 20% with ftt_cc code.

FlexyTrade has 90% off . Use FT400 coupon code. Use these evaluations very wisely. Promo ends end of month. Flexytrade also has instant funding accounts single, bundle of 5 or bundle of 10 of 250K for 30% discount with FT400 coupon code.

Econ for Week

Night session Trading Suggestions:

I suggest to not trade night session from 10 pm to 2 am chop. If action has to happen than it will happen before 10 pm or after 2 am EST. You can generally play short on top level provided for nightly range and long on lower level of nightly range after 2 am or 3 am. But get out of the way if it rips or drops thru levels and wait for new opportunity or flip. And of course never add to loser and better yet cut it and reset.

Remember: I never short above or long below my marker. I wait for it to pause before it or come back to it from rip/dip and pause before executing.

Never take position before Econ like CPI Or FOMC. After econ watch for levels where it stops and how it interacts to decide long or short.

Recommended stop: -2 and go to BE on +2. Some ppl who can't reenter shall chose -3.5/4.

Scale out: 2 lots at +6/8, 3rd at +10/16, 4th leave runner at BE

Big picture: We had short stint inside 400 point chop box during last week of October but now we are back outside, until we go back inside bulls are on full control of the tape.

Rest of the content is for paid sub stack users and is also shared with members on private telegram channel (Note to telegram members: please do not ask me that you do not have sub stack access, you don’t but the content behind paywall is already posted on your channel. Thank you).

Sub stack subscription does not include real time telegram alerts it only includes this nightly news letter with levels and possible setups. For real time alerts please go to https://futuretrader400.substack.com/about