Plan for Nov 6 Wednesday

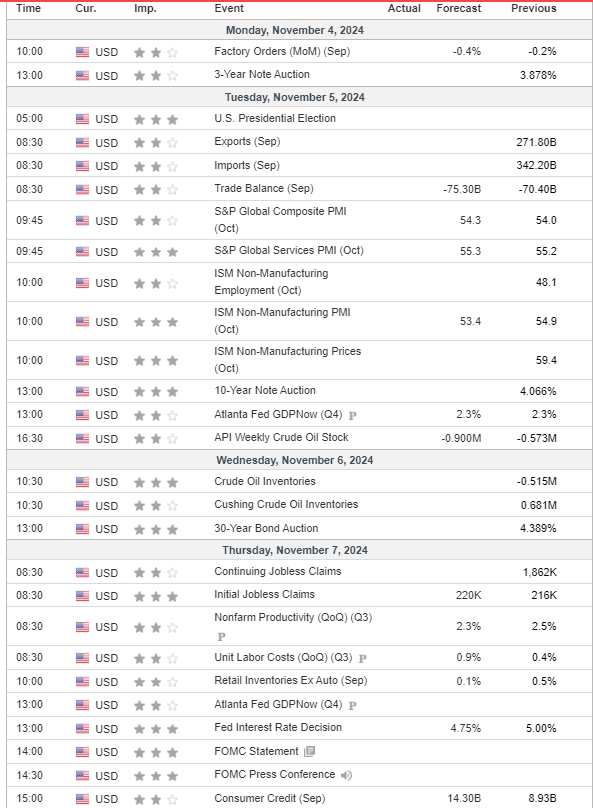

Election and FOMC rate decision this week.

Hello Traders, This week is full of news with PMI, ISM on Tuesday, followed by US election volatility on Tuesday and Wednesday, and FOMC rate decision on Thursday. So expect lot of fireworks. Stay nimble and size small. This is what we did today.

We missed long 56/60 at open. So we sat out and shorted 94/98 area couple times to make our handles. We again shorted in afternoon and made some handles shorting 98/04 area.

Prop Firms Promotions

I will list best promotions on good prop firms going forward. They are best way to learn and make money without blowing up 100’s of thousands of your own dollars. Fast track trading is promising prop firm that you should give a try with huge discount and direct funding without evaluation.

Apex has 80% off evals Use FT400 code. $35 resets. $85 PA activation fee.

TakeProfitTrader 40% Off & no activation fees. Use FT400 code.

FastTrackTrading has Code: HALLOWEEN - 55% off Rally, Daytona and GT and Le Mans with buy 5 get 1 free with wire/ach/crypto and ftt_cc for 55% off these accounts using credit card. There is no evaluation, no activation and no monthly fees.

FlexyTrade Flexytrade also has instant funding accounts single, bundle of 5 or bundle of 10 of 150K/250K/350/500K for 50% discount with FT400FUNDED coupon code.

Econ for Week

Notables are PMI, ISM on Monday, followed by electicion volatility on Wednesday, and FOMC rate decision on Thursday. So expect lot of fireworks.

Night session Trading Suggestions:

I suggest to not trade night session from 10 pm to 2 am chop. If action has to happen than it will happen before 10 pm or after 2 am EST. You can generally play short on top level provided for nightly range and long on lower level of nightly range after 2 am or 3 am. But get out of the way if it rips or drops thru levels and wait for new opportunity or flip. And of course never add to loser and better yet cut it and reset.

Remember: I never short above or long below my marker. I wait for it to pause before it or come back to it from rip/dip and pause before executing.

Never take position before Econ like CPI Or FOMC. After econ watch for levels where it stops and how it interacts to decide long or short.

Recommended stop: -2 and go to BE on +2. Some ppl who can't reenter shall chose -3.5/4.

Scale out: 2 lots at +6/8, 3rd at +10/16, 4th leave runner at BE

Big picture: > 5700 this remains bullish.

Rest of the content is for paid sub stack users and is also shared with members on private telegram channel (Note to telegram members: please do not ask me that you do not have sub stack access, you don’t but the content behind paywall is already posted on your channel. Thank you).

Sub stack subscription does not include real time telegram alerts it only includes this nightly news letter with levels and possible setups. For real time alerts please go to https://futuretrader400.substack.com/about