Plan for Aug 14 Wednesday

CPI tomorrow at 830 AM

Hello Traders,

Going into Globex we had great Pivot 5356 which gave a good start to Globex traders with 40+ points. With RTH open we longed 04 that gave few handles until we called 02-12 chop zone. We longed 18 that gave us 32 where we tried short but it did not work. 32 flip gave a great long which I personally missed as I was away but gave the group to turn long on >35 print. which gave 54 our next level. 5454/56 is Pivot going into Globex today. We are 100 points above yesterday’s Pivot. We are 350 points above last week’s lows as we wait for CPI tomorrow. Trade with small size and only trade setups. Do not trade in between or you get trapped.

FT difference: I always tell traders in my Telegram that its very important to understand that most folks out there just provides levels and then brag about how their levels worked. What we do is provide setups that may or may not be the levels. Setups provides marker for entry with higher odds of making 10 to 20 next points. This is big differentiator vs other services out there that just boasts their levels after the fact. All levels are some kind of confluence and most of them will match with others and that is important but that’s just half ass job. Execution points or setups are more important then that. Hope it makes sense.

Apex has 80% off and pass in 1 trading days, don’t get lured by 1 day passing, its gimmick for you to blow up accounts faster, Use FT400 code. Use these evaluations very wisely.

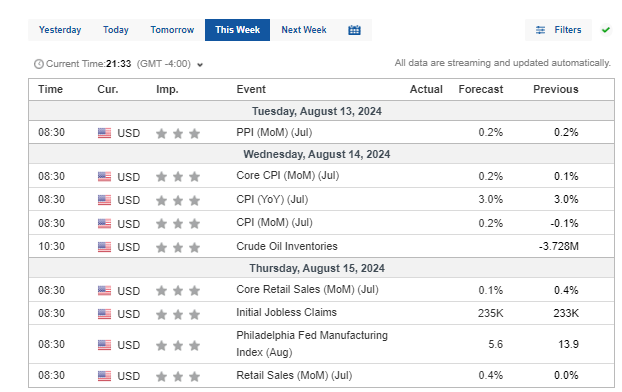

Major Econ for Week

Night session Trading Suggestions:

I suggest to not trade night session from 10 pm to 2 am chop. If action has to happen than it will happen before 10 pm or after 2 am EST. You can generally play short on top level provided for nightly range and long on lower level of nightly range after 2 am or 3 am. But get out of the way if it rips or drops thru levels and wait for new opportunity or flip. And of course never add to loser and better yet cut it and reset.

Remember: I never short above or long below my marker. I wait for it to pause before it or come back to it from rip/dip and pause before executing.

Never take position before Econ like CPI Or FOMC. After econ watch for levels where it stops and how it interacts to decide long or short.

Recommended stop: -2 and go to BE on +2. Some ppl who can't reenter shall chose -3.5/4.

Scale out: 2 lots at +6/8, 3rd at +10/16, 4th leave runner at BE

Big picture: We had short stint inside 400 point chop box during last week of October but now we are back outside, until we go back inside bulls are on full control of the tape.

Rest of the content is for paid sub stack users and is also shared with members on private telegram channel (Note to telegram members: please do not ask me that you do not have sub stack access, you don’t but the content behind paywall is already posted on your channel. Thank you).

Sub stack subscription does not include real time telegram alerts it only includes this nightly news letter with levels and possible setups. For real time alerts please go to https://futuretrader400.substack.com/about