Next week's ES/SPX futures Levels and Setups

September month starts trading near top, can markets continue to push higher?

This is free newsletter sent out every week with setups/levels on ES/SPX futures. For daily setups/levels join my telegram by subscribing thru my substack.

Big prop firm promotions

Apex has 90% off evals Use FT400 code. $37resets and activation $85

Fundingticks (New firm) 20% OFF all Accounts Evals (Pro+) starting at $64 Straight to funded (Zero) starting at $216 Use Code: F400 (its not FT400 ). Now back to business.

Last week , U.S. stocks experienced volatility amid Fed rate-cut anticipation, Nvidia's strong earnings validating the AI boom, and sticky inflation data from July's core PCE (up 2.9% YoY). The S&P 500 hit a record high above 6,500 mid-week but closed Friday down 0.64% at 6,460.26, ending August up ~2% for its fourth straight monthly gain; Nasdaq gained 0.53% to 21,705.16 but lagged weekly. Other events included President Trump's controversial firing of Fed Governor Lisa Cook (prompting a lawsuit and Fed independence concerns), robust housing sales, and sector rotations favoring banks and value stocks over tech. ES/SPX futures mirrored the SPX, trading ~6,439 early week, peaking near 6,502 mid-week on AI optimism, and settling ~6,460 by Friday close, reflecting a net ~0.3% weekly gain with heightened September volatility risks.

Next week, key economic events that could influence indices:

Monday, September 1:

U.S. Labor Day Holiday: Markets closed; no major U.S. data, but global markets (e.g., China’s PMI) may set early tone.

Tuesday, September 2:

ISM Manufacturing PMI: Expected 47.5 (vs. July’s 46.8). Persistent contraction could pressure industrial/cyclical stocks.

Construction Spending: Expected +0.2% MoM. Weak data may signal housing slowdown, impacting related sectors.

Wednesday, September 3:

ADP Private Payrolls: Expected 150K jobs added. A miss could heighten labor market concerns, weighing on S&P 500.

ISM Services PMI: Expected 51.5. A drop below 50 could signal service sector weakness, hitting growth stocks.

Thursday, September 4:

Initial Jobless Claims: Expected 235K. Higher claims could spark fears of labor market softening, pressuring indices.

Trade Balance: Expected -$72B deficit. Tariff impacts may exacerbate deficits, affecting trade-sensitive stocks.

Friday, September 5:

Nonfarm Payrolls: Expected 75K jobs added, unemployment at 4.2%. A weak report could fuel recession fears, potentially causing 1-2% S&P 500/Nasdaq declines; strong data may delay Fed rate cuts.

Here’s a summary of ES futures trading from last week. We continue to get smarter about how many trades we take and staying on sidelines more often by identifying chop areas.

Monday, August 25:

Short vs. 6474 (morning pivot in chop); harvested 2-3 handles gradually toward 6460/6452 support, with limited momentum—advised sitting out if no follow-through.

Attempted long vs. 6474 on potential reversal (conversion play); captured a few handles before flipping back to short.

Re-short vs. 6474 (afternoon); continued paying off in low-volatility "chop shop," holding runner overnight if conviction held.

Overall: Short-dominant in ranging action; pivot at 6474 key, with ~5-10 total handles; Globex focus on 6472/6452.

Tuesday, August 26:

Short vs. 6464/6460 (pre-news/Globex setup); captured handles downside to 6448/6452, especially post-8:30 AM/10 AM news bombs (e.g., Trump-Fed developments), holding runner overnight.

Re-short vs. 6474 (afternoon); jammed lower, yielding additional handles.

Flipped long vs. 6464 (late-day reversal); harvested ~10 handles in the "most hated rally," closing bullish if 6448 held; optional long vs. 6448/6452 for conviction bulls.

Overall: Balanced trades (short early, long late); ~15-20 handles total; levels like 6464 (bull-bear) and 6448/6452 respected on both sides.

Wednesday, August 27:

Short open vs. 6476/6480; initial upside flip to 6502 failed post-NVDA earnings (which "ruined bull party"), leading to downside to 6464; captured handles.

Flipped long vs. 6480; targeted 6516/6540 but limited due to chop; partial handles if filled.

Best idea: Short vs. 6490 in 6476-6494 range; bears needed break below 6476 for conviction.

Overall: Short-dominant (~10 handles); chop between 6476-6494; NVDA reaction hit 6502 high and 6464 low, returning to 6476-6494 chop.

Thursday, August 28:

Long open vs. 6498; captured ~10 handles upward early session.

Flipped short vs. 6498/6502; harvested another ~10 handles downside to 6486, calling it a day after scaling out ("handles are handles").

Missed afternoon long vs. 6490 or 6502 pivots; noted poor execution but setups viable for ~10+ handles each; Globex plan respected morning handles.

Overall: Reversal (long to short); ~20 total handles; ignored external noise, focused on price action.

Friday, August 29:

Bull-bear at 6512 in Globex; yielded 10+ handles overnight into open.

Short open vs. 6498; captured 10+ handles downside.

Re-short vs. 6476; held runner targeting LIS at 6490, liquidated near 6466 amid Friday/holiday chop.

Overall: Short bias (~20 handles); dead tape post-liquidation; potential long vs. 6472 if held, but rotated to 6490/6494 resistance; "anything more is bonus" before long weekend.

Prop Firms Promotions

I will list best promotions on good prop firms going forward. They are best way to learn and make money without blowing up 100’s of thousands of your own dollars.

Apex has 90% off evals Use FT400 code. $37resets.

Fundingticks (New firm) 20% OFF All Accounts Evals (Pro+) starting at $64 Straight to funded (Zero) starting at $216 Use Code: F400 (its not FT400 as their naming does not allow me that code)

TakeProfitTrader 40% Off & no activation fees. Use FT400 code.

TicktickTrader has 55% off Straight to funded accounts, 30% evals. Use FT400 code

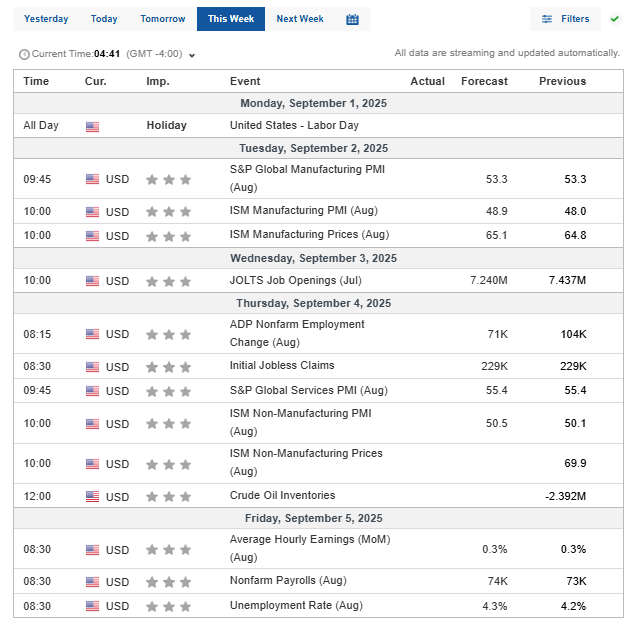

Econ Calendar:

Remember: I never short above or long below my marker. I wait for it to pause before it or come back to it from rip/dip and pause before executing.

Never take position before Econ like CPI Or FOMC. After econ watch for levels where it stops and how it interacts to decide long or short.

Recommended stop: -2 and go to BE on +2. Some ppl who can't reenter shall chose -3.5/4.

Scale out: 2 lots at +6/8, 3rd at +10/16, 4th leave runner at BE

Big picture: > 5700 this remains bullish.

Trading Times Suggestions:

Globex: 2 am to 4 am EST or After 830 Econ

RTH: 930 am thru 11 am and 2 pm to 3:30 pm . First few minutes of open can be choppy.

Levels, & Possible Targets: 🔥🔥= Critical (These are now for September U Contract)

Long term view: As far as > 5700 tape remains in bulls’ control

Bull bear: 6476 (Weekly bull bear level is 6416)

Above: 6490, 6506🔥,6524, 6540, 6566🔥, 6580, 6600

Below: 6476🔥, 6460, 6446🔥, 6430, 6416🔥🔥, 6380 , 6360🔥🔥

Trade ideas: Short is vs 6476 flip if it starts holding. Long is vs 6416 if it reaches there.

Note: Use my globex Pivot/opening setup as main directional guide and then other setups as guidance. Flip or go flat if setup reverses as I may not be in front of my screen all day, you should by now know how the process works at most you have 2/4 handle risk. Setup generally reverses on 1 minute close above/below 3/4 handles from marker. Again there is no sure shot as some time I might relax that or may go predictive. That’s general rule anyway. Also most of the time setups always gives opportunities to reenter some time even multiple times so never take trade too far away from setup markers.