Next week's ES/SPX futures Levels and Setups

September starts with new ATH again but week just closed slightly above the open, PPI on Wednesday and CPI on Thursday with looming FOMC rate cut on Sept 17th.

This is free newsletter sent out every week with setups/levels on ES/SPX futures. For daily setups/levels join my telegram by subscribing thru my substack.

Prop firm promotions (Lame discount so wait out)

Apex has 50% off evals Use FT400 code.

Fundingticks (New firm) 20% OFF all Accounts Use Code: F400 (its not FT400 )

TakeProfitTrader 40% Off & no activation fees. Use FT400 code.

Review of last week trades

Here’s a summary of ES futures trading from last week. We focused on technical analysis, leveraging price action and order flow to identify entry/exit points and key levels (e.g., 6446, 6460, 6476, 6490/94, 6506). We executed both short and long trades, capitalizing on market volatility, with gains ranging from 10 to 100 handles across various setups.

September 3, 2025:

We highlighted a successful short trade from 6476, shared in a free Substack post, which yielded a 100-handle gain. A Globex short at 6446 was also profitable, delivering 10+ handles. We identified 60-64 as key resistance, recommending trailing stops for longs and noting 46 and 12/16 as significant levels below.

We confirmed the 6446 short reached 46, with 46 becoming a short opportunity targeting 16 if bears held below 56. We reported providing 30 handles from shorts between 60, 46, and 30. For the night session, we marked 60 as a critical level, with potential shorts if it held upside and unfinished business at 16 below.

September 4, 2025:

We shared free levels and setups: the bull/bear line was at 6460, with upside levels at 6460 and 6476 (hot), and downside levels at 6446 (hot), 6430, and 6416 (very hot). Trade ideas included longing versus 6460 if it held upside, shorting 6472/76 (noting risk due to a potential breakout to 6500+), and longing the 6442 area for support, with a break below ensuring a move to 6416 or lower. We noted our trading room was long from 6476, targeting 90 and 6506, with 90 hit and longs from 76 or 60 proving profitable. We referenced the 100-handle 6476 short from Tuesday and declared “mission accomplished” as levels were reached. In Globex, we remained long above 6494 and 6506, with all-time highs in play if above 94.

September 5, 2025:

We updated that our trading room was long from 6476, achieving 40+ handles for runners, advising to trail stops as long as above 94. We shorted 6520 after taking longs at 06 and 24, with the 40 FT level respected to the upside. We emphasized 90/94 as critical levels. Specific trades included a 6520 short yielding 6470, a 6476 short yielding 6450, and a 6460 long yielding 6486. We advised keeping profits, avoiding doubling down, and moving to break-even after the first target. We noted chop between 90/94 above and 72/76 below.

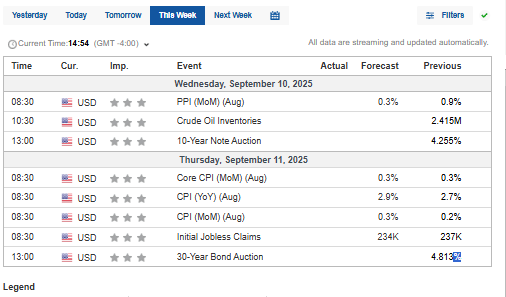

Key Economic events Next week

Key economic events that could influence indices:

Tuesday, September 9: Labor Market Revision

Preliminary Annual Benchmark Revision (BLS, 10:00 AM ET): Adjusts nonfarm payroll data based on QCEW. Upward revisions could boost confidence in economic strength, supporting indices; downward revisions may fuel recession fears, pressuring stocks like financials and consumer discretionary. Impact: High.

Wednesday, September 10: Wholesale Inflation

Producer Price Index (PPI, August, 8:30 AM ET): Expected +0.2% monthly, ~2.8% annually. Higher-than-expected PPI (e.g., due to tariffs) could signal persistent inflation, raising bond yields and hitting tech/growth stocks. Impact: Moderate to high.

Thursday, September 11: Key Inflation Data

Consumer Price Index (CPI, August, 8:30 AM ET): Forecast +0.2% monthly, ~2.7-2.9% annually; core CPI ~0.34%. Strong data may reduce Fed rate cut odds, pressuring Nasdaq and S&P 500; softer data could lift rate-sensitive sectors (e.g., real estate). Impact: Very high, potential 0.5-1% index swings.

ECB Rate Decision (7:45 AM ET): Likely steady rates; dovish signals could weaken EUR/USD, aiding U.S. exporters (Dow stocks). Impact: Moderate.

U. Michigan Consumer Sentiment (Preliminary, 10:00 AM ET): Expected ~68-70. Weak sentiment may weigh on retail/consumer stocks. Impact: Moderate.

Friday, September 12: Sentiment Update

U. Michigan Consumer Sentiment (Final, 10:00 AM ET): Confirms preliminary reading. Persistent weakness could pressure cyclicals. Impact: Low to moderate.

Levels and Setups: 🔥🔥= Critical

(These are now for September U Contract)

Long term view: As far as > 6300 tape remains in bulls’ control

Bull bear: 6494 (Weekly bull bear level is 6464)

Above: 6506🔥,6524, 6540, 6566🔥🔥, 6580, 6600

Below: 6494, 6480🔥, 6464🔥🔥, 6446, 6430, 6406🔥, 6380 , 6360🔥🔥

Setup1: Long vs 6494 as far as it holds downside

Setup 2: Short vs 6494 on conversion for possible dip to 76/80(another long setup) which can extend to 6464

Setup 3: Short vs 6520 as far as it holds upside.

Setup 4: Long vs 6464 as far as it holds downside. Short if this converts.

Trading Times Suggestions

Globex: 2 am to 4 am EST or After 830 Econ

RTH: 930 am thru 11 am and 2 pm to 3:30 pm . First few minutes of open can be choppy.

Setup usage suggestion

Do not try setups more than once if you have to > 3.5 handle stop loss or twice if you are take <=2 handle stop loss. Use my globex Pivot/opening setup as main directional guide and then other setups as guidance. Flip or go flat if setup reverses as I may not be in front of my screen all day, you should by now know how the process works at most you have 2/4 handle risk. Setup generally reverses on 1 minute close above/below 3/4 handles from marker. Again there is no sure shot as some time I might relax that or may go predictive. That’s general rule anyway. Also most of the time setups always gives opportunities to reenter some time even multiple times so never take trade too far away from setup markers.

Size, Stop, Scale out strategy

Remember: I never short above or long below my marker. I wait for it to pause before it or come back to it from rip/dip and pause before executing.

Avoid taking position before Econ like CPI Or FOMC. After econ watch for levels where it stops and how it interacts to decide long or short.

Size: Either 4 micro or 4 emini lots or in multiple of 4’s, risking max 1-5% of your capital.

Recommended stop: Depends on your trading style. You can start with disaster stop of -4 and

Move to -2 once you are +2 on trade

Once you hit T1 you can go to -2 and when you hit T2 you can go to BE Or

Move to BE once you are +2

Move to BE if trade is taking more than 4-5 minutes after entry

Some folks like to keep it all the way to next level though I do not like to keep my trade that loose.

Scale out: 2 lots at +6/8, 3rd at +10/16, 4th start trailing if more than 20 handles on the trade.

Hello send pls special price post in X about new subsription

Thank you.

For anyone interested, here are my Aug CPI estimates:

https://open.substack.com/pub/arkominaresearch/p/aug-2025-cpi-estimate?r=1r1n6n&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false