Next week's ES/SPX futures Levels and Setups

Powell signals september rate cut, Can futures continue to push higher and make another ATH?

This is free newsletter sent out every week with setups/levels on ES/SPX futures. For daily setups/levels join my telegram by subscribing thru my substack. Big prop firm promotions. Apex has 80% off evals Use FT400 code. $50resets and Fundingticks (New firm) 35% OFF all Accounts Evals (Pro+) starting at $64 Straight to funded (Zero) starting at $216 Use Code: F400 (its not FT400 ). Now back to business.

Last week, the S&P 500 and Nasdaq hit new highs as July inflation cooled, boosting expectations for a September Fed rate cut. However, markets showed weakness mid-week, with the S&P 500 slipping ~0.2% and Nasdaq dropping ~0.7% due to concerns over tech valuations and tariff prospects. On Friday, the S&P 500 surged 1.5% after Fed Chair Powell signaled potential rate cuts in September, driving a strong market rally. E-mini S&P 500 futures (ES) fluctuated, retesting weekly pivots before rallying to resistance, then selling off after failing to break higher, ending the week with a slight decline

Next week key earnings reports that could impact stock indices include NVIDIA, Salesforce, and CrowdStrike (all Wednesday, August 27, after market close). Risks include trade tensions, inflation, and cautious guidance, with volatility possible amid Fed rate cut expectations and economic data releases like US New Home Sales and India’s GDP.

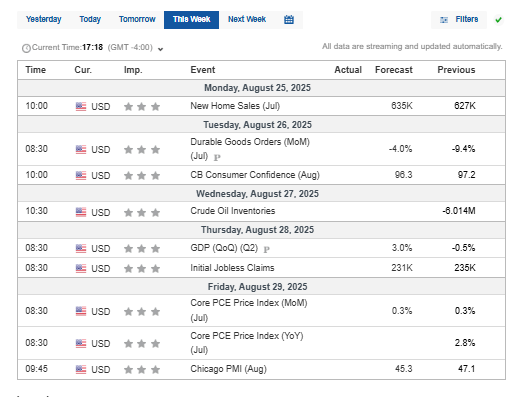

Next week, key economic events could influence indices:

Monday, August 25: US New Home Sales (July) data release could signal housing market strength, impacting real estate and related sectors.

Thursday, August 28: India’s Industrial Production (July) may affect emerging market sentiment, indirectly influencing global indices.

Friday, August 29: India’s Q2 GDP Growth Rate release could sway investor confidence in Asian markets, with ripple effects on global indices.

Sunday, August 31: China’s NBS Manufacturing PMI (August) may impact global markets, particularly sectors tied to Chinese demand, like commodities and tech.

Here’s a summary of ES futures trading from last week. We continue to get smarter about how many trades we take and staying on sidelines more often by identifying chop areas.

August 18, 2025:

I posted that my short position below 6570 was paying off, targeting 6556.

I noted the market was consolidating between 6502 and 6456.

August 19, 2025:

I highlighted 6420 as a key level, maintaining a short position below 6556.

I identified support at 6420 holding, with lower targets at 6400, 6376, and 6360.

August 21, 2025:

I mentioned shorting below 6496 since the 8:30 AM economic data release, targeting 6372/76.

I pointed out resistance at 6416/20.

August 22, 2025:

I took a long position at 6416 but got stopped out, missing a brief spike.

I made up for it by shorting at 6474 and longing at 6556.

Prop Firms Promotions

I will list best promotions on good prop firms going forward. They are best way to learn and make money without blowing up 100’s of thousands of your own dollars.

Apex has 80% off evals Use FT400 code. $50resets.

Fundingticks (New firm) 35% OFF All Accounts Evals (Pro+) starting at $64 Straight to funded (Zero) starting at $216 Use Code: F400 (its not FT400 as their naming does not allow me that code)

TakeProfitTrader 40% Off & no activation fees. Use FT400 code.

TicktickTrader has 55% off Straight to funded accounts, 30% evals. Use FT400 code

Econ Calendar:

Remember: I never short above or long below my marker. I wait for it to pause before it or come back to it from rip/dip and pause before executing.

Never take position before Econ like CPI Or FOMC. After econ watch for levels where it stops and how it interacts to decide long or short.

Recommended stop: -2 and go to BE on +2. Some ppl who can't reenter shall chose -3.5/4.

Scale out: 2 lots at +6/8, 3rd at +10/16, 4th leave runner at BE

Big picture: > 5700 this remains bullish.

Trading Times Suggestions:

Globex: 2 am to 4 am EST or After 830 Econ

RTH: 930 am thru 11 am and 2 pm to 3:30 pm . First few minutes of open can be choppy.

Levels, & Possible Targets: 🔥🔥= Critical (These are now for September U Contract)

Long term view: As far as > 5700 tape remains in bulls’ control

Bull bear: 6474(Weekly bull bear level is 6452)Above: 6474, 6490, 6502🔥, 6516, 6540, 6566🔥, 6580, 6600Below: 6452🔥, 6436, 6420🔥, 6406🔥, 6380 , 6360🔥🔥

Trade ideas: Long > 6474. Possible areas of retracement would be 6502 and 6566 from above. You can long 6452 if it reaches there.

News bombs: 10 am Homes sales.

Note: Use my globex Pivot/opening setup as main directional guide and then other setups as guidance. Flip or go flat if setup reverses as I may not be in front of my screen all day, you should by now know how the process works at most you have 2/4 handle risk. Setup generally reverses on 1 minute close above/below 3/4 handles from marker. Again there is no sure shot as some time I might relax that or may go predictive. That’s general rule anyway. Also most of the time setups always gives opportunities to reenter some time even multiple times so never take trade too far away from setup markers.